| |

Multi-Family Israel - partners of multifamily fund in the USA

Multi-Family Israel is a quality platform for Israeli investors to invest (and even in some cases be part of the general partner) in a smart way in housing clusters in attractive locations in the USA. Our goal, through cooperation with exellent local operators, to generate maximum profits while improving the quality of life of thousands of American tenants!

Multi-Family Israel - Investments management & consulting services

- Advisory based on academic research and models to predict your success

- Proven technological advantage include using the software company we own

- Deep knowledge and record of success in the stock market since 1994. The knowledge from analyzing REITs and other RE companies in the stock markets turned to advantage in selecting the best real estate investments

- Deep research capability and proven success in Israeli & US real estate investments

|

|

Our larger investment service with a personal attitude gives investors the opportunity to gain very high profits from combining different types of investments:

- US Multifamily

- The Israeli capital market

- Real estate investments in Israel

- The US capital market

- Other real estate investments in the US

- Investments in "safe" format with 100% security on the investment fund and a chance to profit in the capital market without risking the money

We provide services both to individuals and to other investment funds who like to give their clients our advantages.

|

| |

|

|

|

|

| |

|

Our technological advantage

- In house software company

- Record of more than 20 years of solutions for achieving extra gains

- CapitalGain3 was developed for monitoring investments in "3 channels" methodology

- Building models for predicting investments success

- The company has years of record as providing consulting and other services also to companies listed in the "Top25" Israeli largest

|

| |

Eran Ron – Managing Partner at the fund

Mr. Ron has been active since 1993 in the business world related to investments, real estate, management and computer programming.

With his many years of experience and special multi-disciplinary knowledge, Eran Ron manages investments that combine different methods in the capital market and real estate with great success.

Mr. Ron is an expert with proven success in the U.S. real estate in targeting markets and assets for delivering maximum appreciation using analyzation brought also by unique software tools he has developed for investment's competitive advantage.

Among the clients of Eran and the group's diverse consulting services over the years are also the leading organizations in Israel: Leumi Bank, Discount Bank, the Israeli government, the Histadrut and more.

Eran Ron has Business management (summa cum laude) and Computer science degrees from top Israeli universities.

|

|

Summary of the benefits of Eran Ron relevant to the Multifamily fund:

- Proven ability to achieve high profits in real estate investments in the U.S.

- Technological advantage: manages development of software tools to gain a competitive advantage in investments

- Proven ability in closing deals even with the largest organizations

- Personally receives trust from the high-quality real estate companies from the USA, with proven ability to be a high-quality local partner for the fund.

|

| |

Examples of recent successes in US real estate (in single-family activity):

As known, in real estate investments we strive to achieve maximum profit in two main parameters: the increase in the value of the property and the current "yielding" income (from the rent). The examples of the properties are from our portfolio activity in Philadelphia, PA:

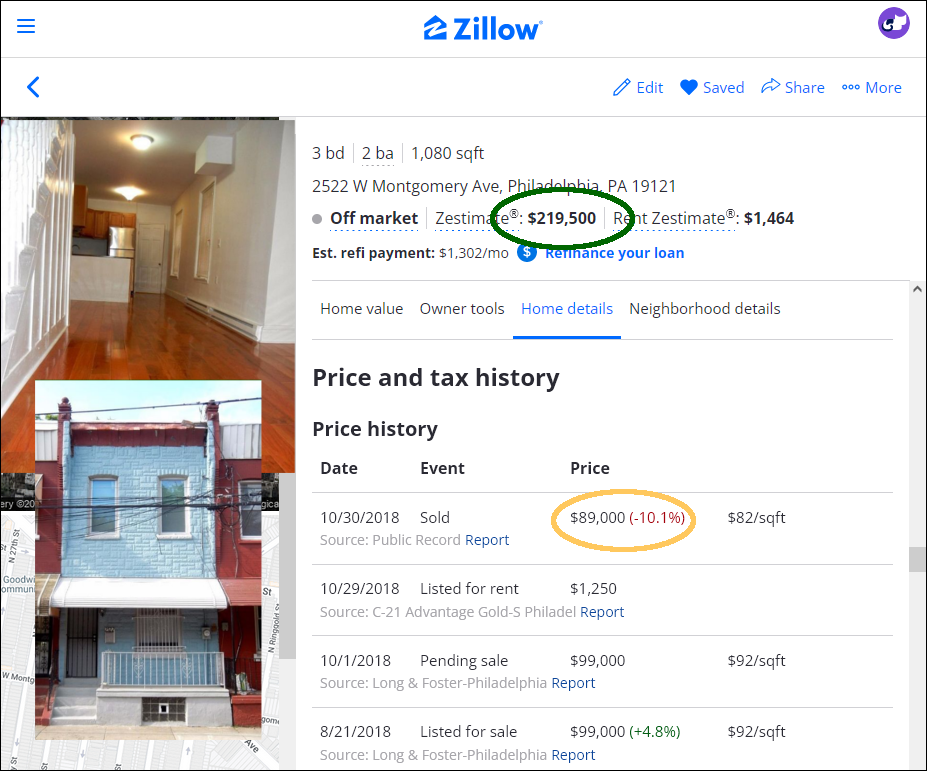

1. Montgomery Ave. asset

My goal at that deal was to find an asset with tools of identifying gentrification so it will gain the maximum appreciation possible. And at current time 2022, the report about Philadelphia appreciation shows that I was successful at putting a finger on the place that gained one of the largest appreciations in the city since 2018.

With this property on Montgomery Ave. in Philadelphia, you can see the increase in value of more than 240% (from our purchase price of $89,000 to the estimated value on the day of writing of over $219,000) since October 2018. At current, this property generates rent of $1400 per month.

The full calculation of this asset's IRR is as follows:

Year

|

Net income

|

Caption/ Remark

|

2018

|

|

Home bought with expenses - hud1

|

2018

|

-93,711

|

Total with additional expenses

|

2019

|

9,236

|

|

2020

|

6,612

|

|

2021

|

6,675

|

|

2022

|

211,800

|

Home virtually sold after assumed expenses + year of rent

|

|

140,612

|

Total

|

|

27.86%

|

IRR calculated

|

The Montgomery asset from 2018

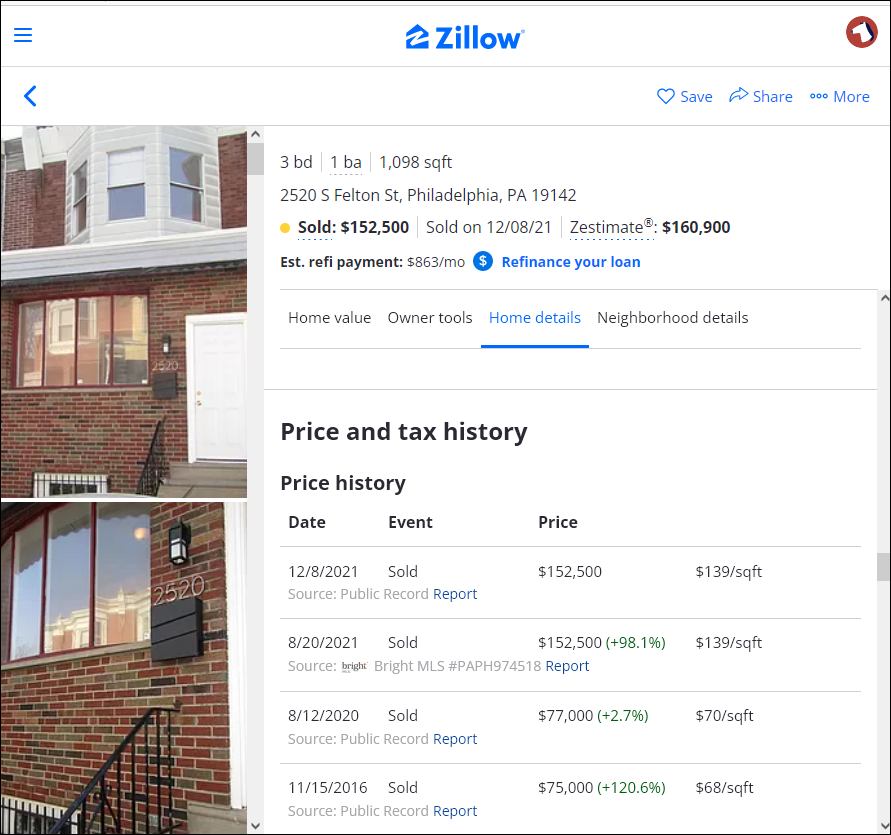

2. Felton Street asset

Another example of a property in which the investment was in the strategy of bringing value through an upgrade ("flip"). This property was purchased by us for $77,000 and sold after a partial renovation for $145,000 (the amount listed on records, $152,000, includes a portion that was returned to the buyer to pay his expenses as part of the transaction and is called Seller Assist).

The full calculation of this asset's IRR is as follows:

Year

|

Net income

|

Caption/ Remark

|

2020

|

|

Home bought with expenses - hud1

|

2020

|

-108,789

|

Total first year with repairs & additional expenses

|

2021

|

129,431

|

Home sold net income (after all selling expenses) & annual expenses

|

|

20,642

|

Total

|

|

18.97%

|

IRR calculated

|

The Felton asset from 2020 The Felton asset from 2020

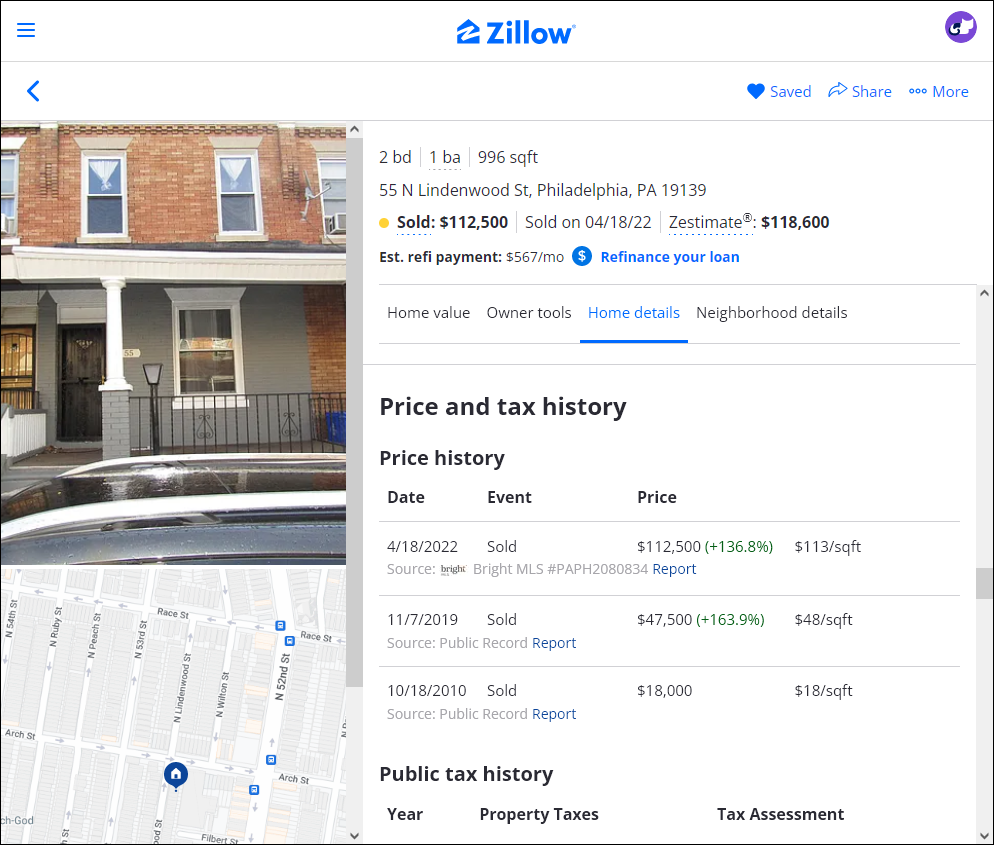

3. Lindenwood Street asset – Example of achieving gain while overcoming Covid 19 & eviction problems

This example of a property that in the trouble times of Covid we had to evict non cooperating tenant. My target was to shorten expenses and act in a way that, despite troubles and Covid limitations, this property was still profitable.

Year

|

Net income

|

Caption/ Remark

|

2019

|

|

Home bought with expenses - hud1

|

2019

|

-78,246

|

Total first year with repairs & additional expenses

|

2020

|

-2,926

|

Total first year with repairs & additional expenses

|

2021

|

-6,544

|

|

2022

|

102,760

|

Home sold net income (after all selling expenses)

|

|

15,044

|

Total

|

|

5.76%

|

IRR calculated at troubled asset

|

The Lindenwood asset from 2019 The Lindenwood asset from 2019

|

|

|

|

Contact our office:

14 Rambam St. Givat Shmuel 5401045 Israel

US Phone Number: 267-481-7550

Tel Aviv Phone Number: +972-3-5325470

e - mail : inf o @ mu lti - fa mily.c o.i l (please remove the spaces, they just there to prevent spam robots)

Please fill out the contact form and we will get back to you soon

|

|

Multi-Family Israel works upon the Israeli law and the guidance of the Israeli securities authority. The authors may have personal interest in the content. We and the Israeli Sec. advise the users to get personal professional advice that will take in care each person's specific data and needs. This site is no substitute to such advice. The information in this site is served "As Is" and with no warranty to any success in investing activity. Be aware that investing in securities involves risk.

Note about our rebranding at 2022 :

The rebranding was process of change from working with the brand "Shield1" and the internet domain name hedgefunds.biz to the brand "Multi Family Israel" and to our current domain name : multi-family.co.il . That was done along with our marketing team to emphasize our expertise on US Multifamily investments separated from our broader investments activity.

site ver: 23.42

credits:

Image by graystudiopro1 on Freepik

|

| |

|